The Final Step: Assessing Your Assets at the End of the Asset Management Cycle

In today’s fast-paced South African business environment, effective asset management goes beyond simply tracking and maintaining IT equipment. A critical part of this process is asset management cycle assessment, ensuring that assets deliver value throughout their lifecycle from procurement to disposal. As you approach the end of your asset management cycle, it’s time to assess the value and impact of each asset, making sure you’re not only complying with local regulations like POPIA, but also positioning your business for long-term success in our challenging economic climate.

Why Asset Management Cycle Assessment Matters

The final step in asset management—assessment—is vital for South African businesses looking to optimise their IT infrastructure and improve sustainability efforts. Whether you’re evaluating hardware that has reached its end-of-life or deciding on the best practices for recycling or disposal, this phase is about making informed, strategic decisions that make financial sense while meeting regulatory requirements.

Why Many South African Businesses Opt to Dispose of Assets at the End of the Financial Quarter

Many companies in South Africa choose to dispose of or assess their IT assets at the end of each financial quarter. This practice is driven by a few key factors particularly relevant to our local business environment:

1. Financial Reporting & Tax Benefits:

At the end of a financial quarter, businesses often take stock of their assets to ensure their balance sheet is accurate. Disposing of outdated or unused assets can free up space, and in some cases, companies may be able to claim tax deductions for asset depreciation or write-offs through SARS, improving their financial position for the next quarter. In South Africa’s current economic climate, these tax benefits can provide significant relief to businesses managing tight budgets.

2. Budget Planning & Resource Allocation:

The end of the quarter is a logical time for companies to evaluate their IT needs and reallocate resources. Disposing of unused or outdated assets and replacing them with more efficient models allows businesses to streamline their operations and plan for future growth. This is especially important for South African companies dealing with currency fluctuations that affect the cost of importing new technology.

3. Improved Inventory Management:

By regularly assessing assets at the end of each quarter, companies can maintain accurate inventories of their IT equipment. This helps reduce unnecessary capital expenditure on underutilised assets while ensuring the business is not overspending on technology that is no longer required. For organisations trying to optimise operations during load-shedding, having an accurate inventory of power-efficient equipment is particularly valuable.

Key Aspects to Assess During the Asset Management Cycle:

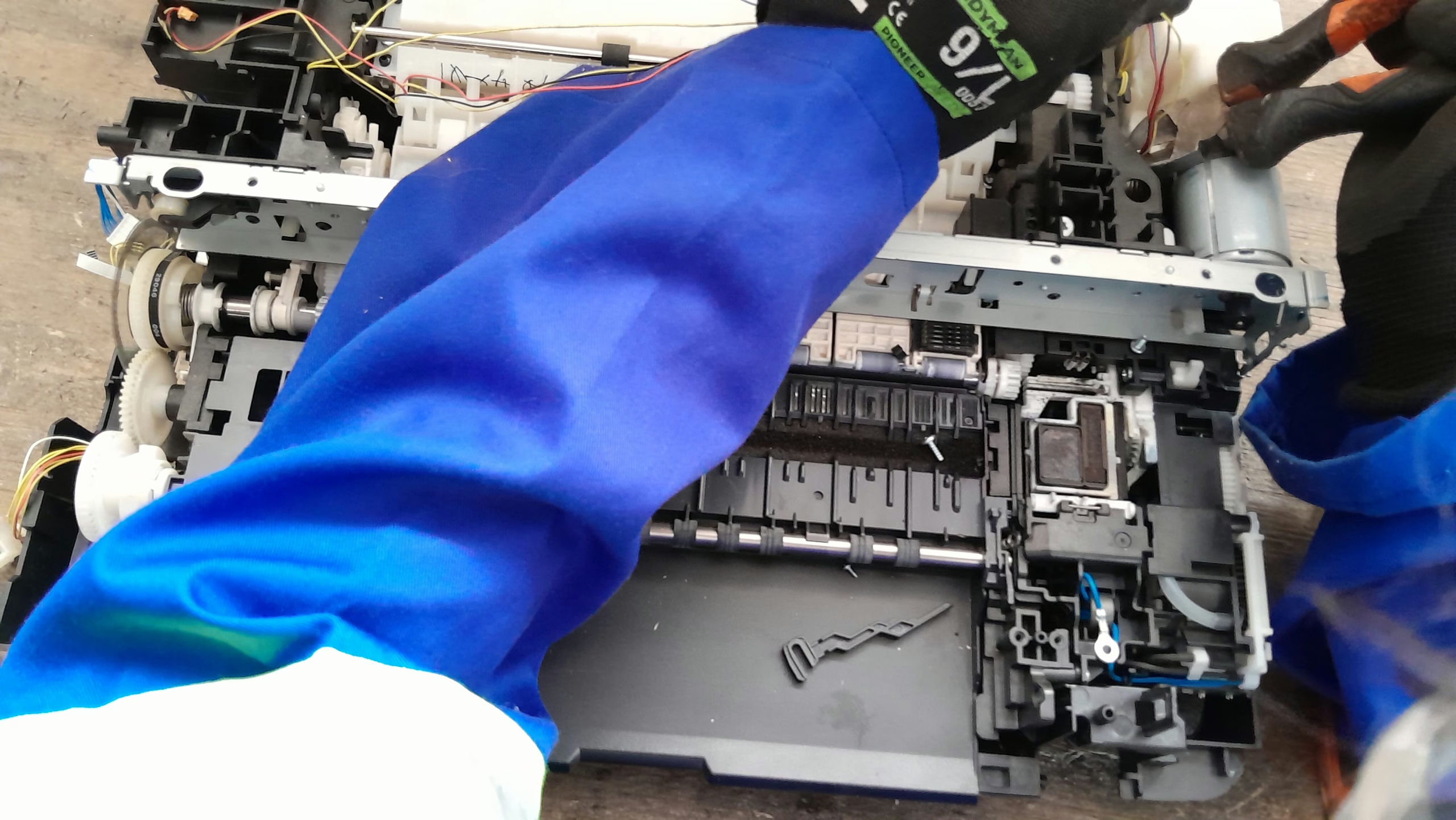

1. Physical Condition:

Inspect each asset’s physical state, can it still serve its intended purpose, or is it becoming a liability? Look for wear and tear that could impact its performance or security. In South Africa’s variable climate conditions and with the added strain of power fluctuations during load-shedding, equipment may deteriorate faster than in other regions.

2. Data Security and Compliance:

Data breaches are one of the biggest risks during the asset disposal process. Before disposal, ensure that all sensitive data is properly erased using certified methods to avoid compliance violations with POPIA. This is critical for protecting your company’s reputation and avoiding potential fines from the Information Regulator of South Africa. Remember that under POPIA, your organisation remains responsible for personal information even during the disposal process. For more details, check out the POPIA Compliance Guide.

3. Environmental Impact:

With increasing focus on sustainability and South Africa’s commitment to reducing its carbon footprint, it’s important to ensure that your e-waste disposal is environmentally responsible. Opt for certified recycling services that comply with the National Environmental Management: Waste Act (NEMWA) and industry standards like ISO 14001 to reduce your environmental impact and support South Africa’s growing green economy.

4. Financial Value:

Consider the potential for asset recovery. In some cases, older equipment can be refurbished or resold to offset the costs of new acquisitions. Assessing the asset’s current value and reuse potential can help you save money—an important consideration given the rand’s fluctuating value and the high cost of importing new technology into South Africa.

5. End-of-Life Decision:

After evaluating the asset, you’ll need to decide whether to retire, resell, recycle, or repurpose it. This decision should factor in its residual value, compliance requirements, and environmental impact. Many South African businesses are choosing to donate functional but outdated equipment to schools or NPOs, supporting digital literacy while gaining potential BEE points.

How We Help with Asset Management Cycle Assessment in South Africa

At our company, we specialise in IT asset management for the South African market, with a focus on sustainability and compliance with local regulations. Our process includes thorough assessments of your IT assets, helping you make informed decisions in the context of South Africa’s unique business environment.

Whether you’re looking to recycle responsibly in accordance with NEMWA requirements, refurbish equipment for reuse in rural communities, or ensure POPIA compliance during disposal, we offer certified services that meet all legal and environmental standards.

Our expert team guarantees that all data is securely erased with ISO-certified methods, and we provide comprehensive Certificates of Recycling and Data Destruction for your peace of mind and regulatory documentation. By working with us, you can confidently manage your assets at the end of their lifecycle, knowing that you’re both compliant with South African regulations and contributing to sustainable development goals. To learn more about our IT Asset Management Solutions, check out our services.

Our facilities operate with backup power solutions to ensure uninterrupted service during load-shedding, so your asset disposition processes won’t be affected by power outages—allowing you to meet your quarterly financial deadlines without disruption.